How to Calculate ROI in Jira for Better Investment Decisions Using Dynamic Scoring

Return on Investment (ROI) is essential for teams evaluating whether a feature, project, or initiative is worth the cost. But Jira was never designed for financial metrics until now.

Dynamic Scoring for Jira introduces a dedicated Financial scoring model that lets teams calculate ROI directly in the issue view, turning Jira into a lightweight investment assessment platform.

Why ROI Matters for Modern Product Organizations

ROI is one of the simplest and most universal financial metrics:

ROI = (Value – Cost) ÷ Cost

ROI provides three powerful benefits:

1. Strong business justification

It gives leadership a clear, quantitative view of why a feature deserves investment.

2. Improved capital allocation

Portfolios often have dozens of competing initiatives; ROI highlights which ones bring the biggest return per dollar spent.

3. Clearer decision-making

ROI supports go/no-go decisions, especially for expensive projects.

Why ROI in Jira Is Hard Without a Tool

Teams typically rely on:

- spreadsheets

- slide decks

- rough “effort vs. value” discussions

This leads to scattered documentation and data that quickly becomes outdated.

With Dynamic Scoring, ROI becomes:

- consistent

- visible

- part of every issue

- easy to compare across epics and features

How to Configure ROI in Jira Using Dynamic Scoring

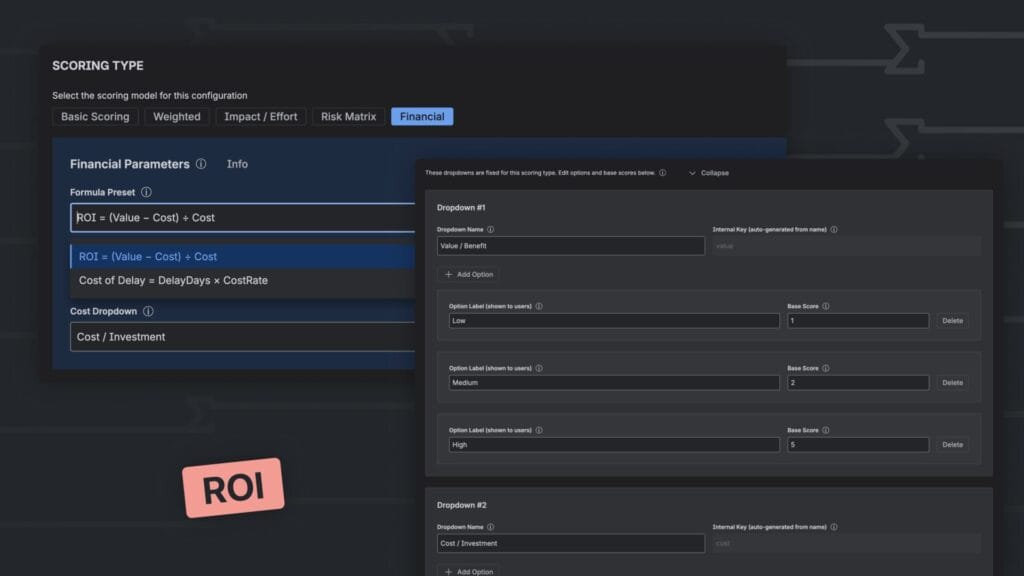

Best Model: Financial

The Financial scoring type includes a built-in ROI formula.

Step-by-Step ROI Configuration

1. Create the Configuration

Name: ROI

2. Select Scoring Type

Choose: Financial

3. Add the required dropdowns

| Field | Purpose | Options |

|---|---|---|

| Value / Benefit | Expected business or customer value | Low / Medium / High |

| Cost / Investment | Cost, effort, or budget | Low / Medium / High |

You can assign real numerical values or proxy scores.

4. Select Formula Preset

Choose the built-in formula:

ROI = (Value – Cost) ÷ Cost

5. Save → Use in Jira Issue View

Instant ROI scoring for every initiative.

How Agile Teams Use ROI in Practice

• Strategic Roadmapping

Helps prioritize high-value long-term projects.

• Leadership alignment

Provides a shared financial language between PMs, Engineering, and executives.

• Portfolio management

Supports multi-product organizations selecting which initiatives to fund.

Beyond ROI

Dynamic Scoring also supports:

- Risk-adjusted ROI

- Weighted decision models

- Risk Matrix scoring

- WSJF and other Lean metrics

- Custom formulas for financial teams

This flexibility makes it useful for both product and strategic leadership.

Read More

[{"id":3372,"link":"https:\/\/typeswitch.net\/blog\/ice-in-jira-impact-confidence-effort-fast-prioritization-using-dynamic-scoring\/","name":"ice-in-jira-impact-confidence-effort-fast-prioritization-using-dynamic-scoring","thumbnail":{"url":"https:\/\/typeswitch.net\/wp-content\/uploads\/2025\/12\/ICE.jpg","alt":""},"title":"ICE in Jira (Impact, Confidence, Effort): Fast Prioritization Using Dynamic Scoring","postMeta":[],"author":{"name":"meltedmensoftware@gmail.com","link":"https:\/\/typeswitch.net\/blog\/author\/meltedmensoftwaregmail-com\/"},"date":"\u0413\u0440\u0443 2, 2025","dateGMT":"2025-12-02 13:08:51","modifiedDate":"2025-12-12 08:30:02","modifiedDateGMT":"2025-12-12 08:30:02","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/typeswitch.net\/blog\/category\/atlassian\/jira-app\/\" rel=\"category tag\">Jira App<\/a>","space":"<a href=\"https:\/\/typeswitch.net\/blog\/category\/atlassian\/jira-app\/\" rel=\"category tag\">Jira App<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":1,"sec":42},"status":"publish","content":"How to Calculate ICE Scores in Jira for Fast, Lightweight Prioritization The ICE framework (Impact, Confidence, Effort) is a simple"},{"id":3350,"link":"https:\/\/typeswitch.net\/blog\/rice-in-jira-reach-impact-confidence-effort-a-complete-guide-to-scoring-with-dynamic-scoring\/","name":"rice-in-jira-reach-impact-confidence-effort-a-complete-guide-to-scoring-with-dynamic-scoring","thumbnail":{"url":"https:\/\/typeswitch.net\/wp-content\/uploads\/2025\/12\/RICE.jpg","alt":""},"title":"RICE in Jira (Reach, Impact, Confidence, Effort): A Complete Guide to Scoring with Dynamic Scoring","postMeta":[],"author":{"name":"meltedmensoftware@gmail.com","link":"https:\/\/typeswitch.net\/blog\/author\/meltedmensoftwaregmail-com\/"},"date":"\u0413\u0440\u0443 2, 2025","dateGMT":"2025-12-02 12:36:41","modifiedDate":"2025-12-12 08:31:25","modifiedDateGMT":"2025-12-12 08:31:25","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/typeswitch.net\/blog\/category\/atlassian\/jira-app\/\" rel=\"category tag\">Jira App<\/a>","space":"<a href=\"https:\/\/typeswitch.net\/blog\/category\/atlassian\/jira-app\/\" rel=\"category tag\">Jira App<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":1,"sec":41},"status":"publish","content":"How to Calculate RICE Scores in Jira for Data-Driven Product Prioritization RICE (Reach, Impact, Confidence, Effort) is one of the"},{"id":3341,"link":"https:\/\/typeswitch.net\/blog\/roi-in-jira-return-on-investment-how-to-measure-value-vs-cost-using-dynamic-scoring\/","name":"roi-in-jira-return-on-investment-how-to-measure-value-vs-cost-using-dynamic-scoring","thumbnail":{"url":"https:\/\/typeswitch.net\/wp-content\/uploads\/2025\/12\/ROI.jpg","alt":""},"title":"ROI in Jira (Return on Investment): How to Measure Value vs. Cost Using Dynamic Scoring","postMeta":[],"author":{"name":"meltedmensoftware@gmail.com","link":"https:\/\/typeswitch.net\/blog\/author\/meltedmensoftwaregmail-com\/"},"date":"\u0413\u0440\u0443 2, 2025","dateGMT":"2025-12-02 12:03:00","modifiedDate":"2025-12-12 08:33:26","modifiedDateGMT":"2025-12-12 08:33:26","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/typeswitch.net\/blog\/category\/atlassian\/jira-app\/\" rel=\"category tag\">Jira App<\/a>","space":"<a href=\"https:\/\/typeswitch.net\/blog\/category\/atlassian\/jira-app\/\" rel=\"category tag\">Jira App<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":1,"sec":51},"status":"publish","content":"How to Calculate ROI in Jira for Better Investment Decisions Using Dynamic Scoring Return on Investment (ROI) is essential for"},{"id":3288,"link":"https:\/\/typeswitch.net\/blog\/wsjf-in-jira-weighted-shortest-job-first-how-to-calculate-and-prioritize-work-using-dynamic-scoring\/","name":"wsjf-in-jira-weighted-shortest-job-first-how-to-calculate-and-prioritize-work-using-dynamic-scoring","thumbnail":{"url":"https:\/\/typeswitch.net\/wp-content\/uploads\/2025\/12\/Weighted.jpg","alt":"WSJF"},"title":"WSJF in Jira (Weighted Shortest Job First): How to Calculate and Prioritize Work Using Dynamic Scoring","postMeta":[],"author":{"name":"meltedmensoftware@gmail.com","link":"https:\/\/typeswitch.net\/blog\/author\/meltedmensoftwaregmail-com\/"},"date":"\u0413\u0440\u0443 2, 2025","dateGMT":"2025-12-02 09:49:26","modifiedDate":"2025-12-12 08:33:47","modifiedDateGMT":"2025-12-12 08:33:47","commentCount":"0","commentStatus":"closed","categories":{"coma":"<a href=\"https:\/\/typeswitch.net\/blog\/category\/atlassian\/jira-app\/\" rel=\"category tag\">Jira App<\/a>","space":"<a href=\"https:\/\/typeswitch.net\/blog\/category\/atlassian\/jira-app\/\" rel=\"category tag\">Jira App<\/a>"},"taxonomies":{"post_tag":""},"readTime":{"min":2,"sec":40},"status":"publish","content":"How to Implement WSJF in Jira for Agile, Flow-Driven Prioritization Using Dynamic Scoring Weighted Shortest Job First (WSJF) is one"}]